Distributor Businesses Look Strong in 2020

Recent News SCOPE™ 3/13/20 9:47 AM Easton Kuboushek 7 min read

In a recent conversation, a manufacturer shared a unique perspective about how they consume data:

"Applying data is about understanding and managing exceptions," he said.

Like the back corner shelves of a distributor warehouse – data is inherently messy. How some of it got there is complicated. There's clutter to sort through before anyone can determine what's valuable and what should be thrown to the wind.

His insight acknowledged that a "perfect dataset" simply does not exist. Meaning exceptions must be qualified in order to gain accurate insight.

Circumstances have created some new exceptions for the NASGW recently. The loss of four distributors in 2019 left our association and industry with questions about the future, though our distributor partners are clearly rising to the challenge of adjusting and growing their market share. But the loss of those distributors did leave us with an important new exception and question to address in how we manage this change in SCOPE.

How do we measure overall shipment growth against overall market growth?

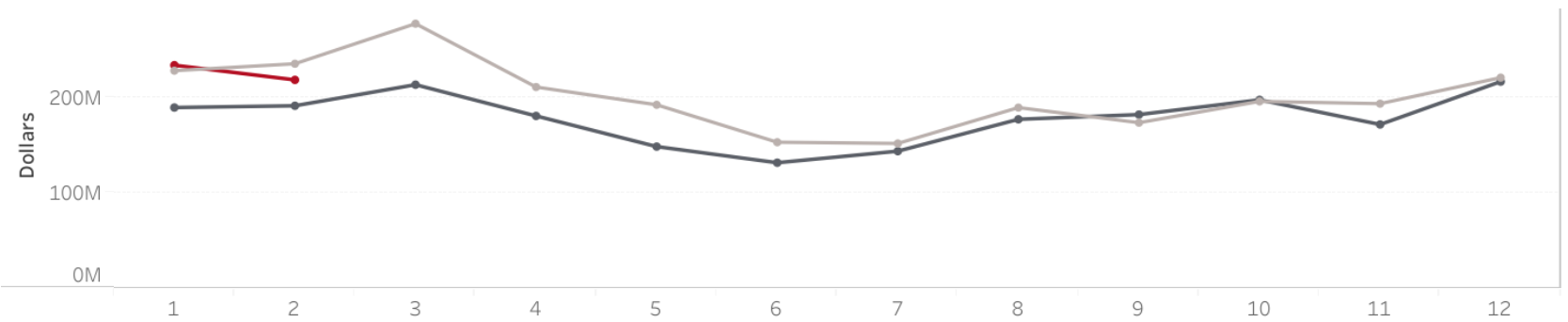

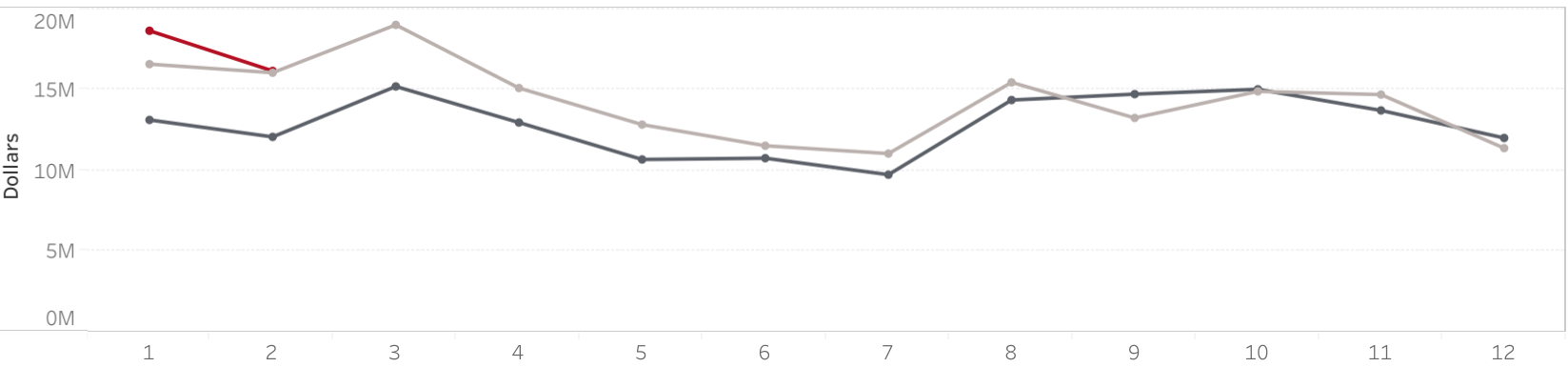

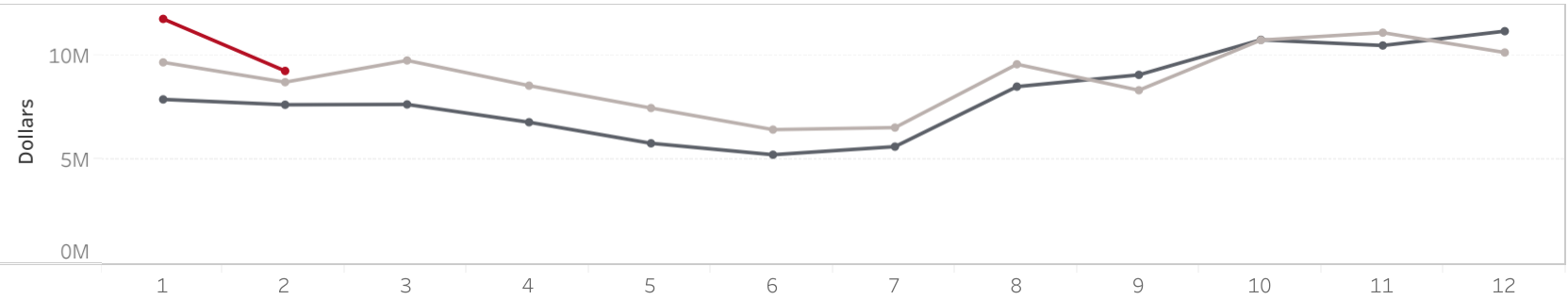

Team SCOPE recently launched a new Market Snapshot dashboard. This new iteration isolates continuous operation distributors (COD). The result allows users to analyze shipment growth of 16 COD, and compare current conditions to the three-year average (3YR AVG) which includes four distributors no longer operating.

The data tells a story that shipments by COD have grown 14 to 38 percent from last year in specific categories.

In addition, COD are maintaining or exceeding the the 3YR AVG. Firearm shipments YTD are down only 2.4 percent from this time last year, Ammunition and Optics are both up.

Take a look at the screenshots from the new Market Snapshot dashboard below. A complete list of distributors is annotated below the charts. Login to SCOPE to see how your business compares.

We hope you find this analysis useful and we welcome your feedback. SCOPE continues to improve thanks to our partners and very soon, SCOPE CLX will help take our industry to the next level of business intelligence.

Your partner in data,

Easton Kuboushek

Director of Data Programs

easton@nasgw.org

+1 (563) 379-6665

SCOPE™ Distributor Shipment Trends

Firearms Shipments

|

2020 (Con Ops) |

2019 (Con Ops) |

3YR AVG (All Data 2019, 2018, 2017) |

%CNG: Con Ops |

%CHG: 2020 vs. 3YR AVG |

|

| February | $218,149,121 | $191,019,374 | $234,976,335 | + 14.20% | – 7.16% |

| YTD | $451,593,040 | $380,201,142 | $462,699,643 | + 18.78% | – 2.40% |

Ammunition Shipments

|

2020 (Con Ops) |

2019 (Con Ops) |

3YR AVG (All Data 2019, 2018, 2017) |

%CNG: Con Ops |

%CHG: 2020 vs. 3YR AVG |

|

| February | $16,189,143 | $12,091,758 | $16,067,664 | + 33.89% | + 0.76% |

| YTD | $34,856,575 | $25,233,743 | $32,667,647 | + 38.13% | + 6.70% |

Optics Shipments

|

2020 (Con Ops) |

2019 (Con Ops) |

3YR AVG (All Data 2019, 2018, 2017) |

%CNG: Con Ops |

%CHG: 2020 vs. 3YR AVG |

|

| February | $9,277,222 | $7,649,369 | $8,728,484 | + 21.28% | + 6.29% |

| YTD | $21,029,775 | $15,553,061 | $16,403,277 | + 35.21% | + 14.27% |

SCOPE distributors in continuous operation for Firearms include: AmChar Wholesale, Bangers USA, Big Rock Sports, Bill Hicks & Co, Camfour-Hill Country, Chattanooga Shooting Supplies, Davidson's Inc, Gun Accessory Supply, Gunarama Wholesale, Hicks Inc, Lipsey's, Orion Wholesale, WL Baumler, Tactical Gear Distributors, Zanders Sporting Goods and Sports South.

SCOPE distributors in continuous operation for Ammunition and Optics include all listed above, with the exception of Sports South.

The 3-year Average includes shipment data from 2019, 2018 and 2017 for all categories from all distributors listed above plus four additional distributors no longer operating. These include: Green Supply, LM Burney, United Sporting Companies and Williams Shooter Supply.