The Soaring Ammunition Market and a Record Week for Distributors

Recent News SCOPE™ 4/1/20 1:00 PM Easton Kuboushek 4 min read

|

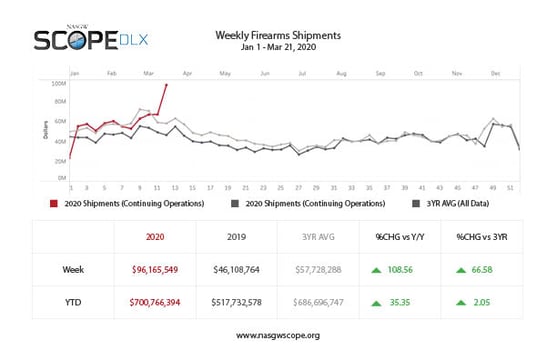

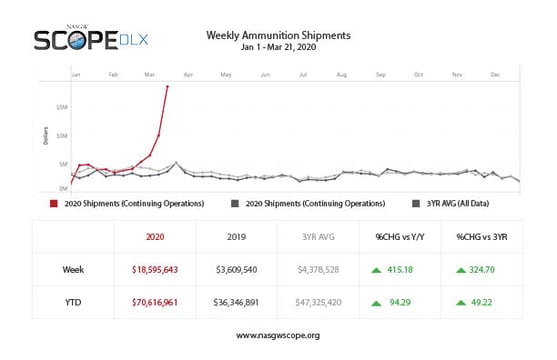

As we pass the 15-day mark, in the U.S.'s Flattening the COVID-19 Curve timeline, the National Association of Sporting Goods Wholesalers (NASGW) SCOPE data platform reports another record week in firearms and ammunition shipments. Ammunition sales nearly doubled for the week ending March 21. When we look at year-to-date (YTD) numbers for 2020, ammunition sales are up 49% compared to the three-year average (3YR AVG), and 188% and the week-over-week, growing from $9.9m to $18.6m. |

|

|

All in all, SCOPE DLX revealed that it was another massive week for the ammunition market and our distributors, as COVID-19 continues to have a widespread impact on our industry. This unparalleled industry tool helps distributors and manufacturers by providing them with easy to understand data and information about real market situations so they can make better decisions. "Our partners continue to navigate the uncharted waters of COVID-19 with SCOPE DLX as a 'compass,'" says Easton Kuboushek, NASGW Director of Data Programs. "It's rewarding to see members ask questions and engage in SCOPE more frequently."

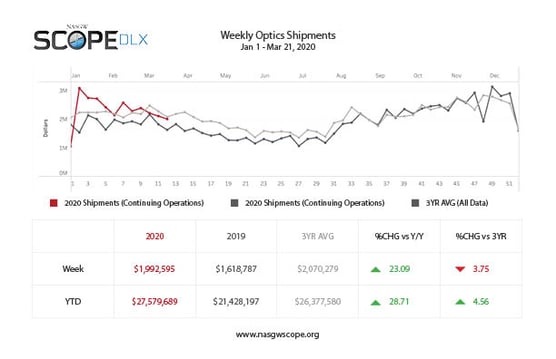

While still on the rise, optics shipments were still below the 3YR AVG at -4%. For the 2020 YTD shipments, they rose 5%, and their year-over-year growth was a little over 28% YTD.

|

|

NASGW SCOPE is an industry-leading data analytics platform. Built, in partnership, with shooting sports manufacturers, distributors, and retailers, SCOPE DLX collects weekly shipment data from 20 leading distributors that represent demand from thousands of FFLs across the United States. NASGW SCOPE is an industry-owned, distributor led initiative designed to help shooting sports businesses collect and analyze data. NASGW recently announced the acquisition of CustomerLink Exchange (CLX) and the integration of point-of-sale data into the SCOPE platform. SCOPE CLX, powered by eComSystems, Inc, will soon be released with benefits for shooting industry manufacturers, distributors, and retailers. To learn more about SCOPE and the upcoming launch of SCOPE CLX, visit nasgwscope.org or contact scope@nasgw.org to see how SCOPE data can benefit your business.

|

About NASGW

The National Association of Sporting Goods Wholesalers is comprised of wholesalers, manufacturers, independent sales reps, media and service providers - both national and international - all of whom are primarily focused on shooting sports equipment and accessories. As a trade association representing the business interests of its members, NASGW's mission is to bring shooting sports buyers and sellers together. For more information about the NASGW, visit the association's website at www.nasgw.org.

About SCOPE DLX Data

SCOPE DLX Distributors in continuous operation for Firearms include: AmChar Wholesale, Bangers USA, Big Rock Sports, Bill Hicks & Co, Camfour-Hill Country, Chattanooga Shooting Supplies, Davidson's Inc, Gun Accessory Supply, Gunarama Wholesale, Hicks Inc, Lipsey's, Orion Wholesale, WL Baumler, Tactical Gear Distributors, Zanders Sporting Goods, and Sports South. Sports South is not included in the ammunition or optics trend.

The 3-year Average includes shipment data from 2019, 2018 and 2017 from all distributors listed above plus four additional distributors no longer operating. These include: Green Supply, LM Burney, United Sporting Companies, and Williams Shooter Supply.