Failing to plan is essentially planning to fail. Every industry has shifts in supply and demand around particular seasons, but it hits the outdoor industry especially hard. If you don’t order and stock guns, ammunition, and other items far enough ahead of when consumers need them, you can’t sell them. Bring in too much too late and you’re losing money on inventory. Nobody needs a turkey shotgun mid-summer. You no longer have to just guess. SCOPE provides data that drives fact-based planning.

Failing to plan is essentially planning to fail. Every industry has shifts in supply and demand around particular seasons, but it hits the outdoor industry especially hard. If you don’t order and stock guns, ammunition, and other items far enough ahead of when consumers need them, you can’t sell them. Bring in too much too late and you’re losing money on inventory. Nobody needs a turkey shotgun mid-summer. You no longer have to just guess. SCOPE provides data that drives fact-based planning.

Hunting seasons are seasonal by nature, determined by state wildlife organizations based on game breeding and migration cycles. In example, 2019 waterfowl shotshell shipments saw the greatest numbers August through October with a peak in September. This coincides with the September to January waterfowl seasons. All this inventory is front-loaded, ready at the beginning of the season. Shipments dip from January to February as the season ends, but don’t fall to their lowest until May. This suggests hunters may be replenishing their supplies for the next season.

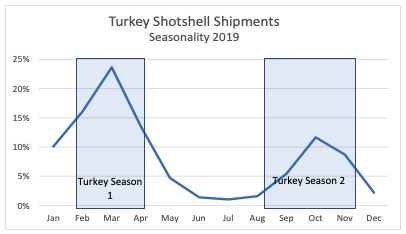

A singular “season” may also be split into two with very different attributes. Turkey season is a particularly good example. Spring turkey season is far more popular than fall turkey season. This is largely due to the fact there are so many things to hunt in the fall that cannot be hunted in the spring (deer, elk, etc.) hunters have to make a choice. Shotshell data from SCOPE provides hard evidence to support this. 2019 turkey shotshell shipments reflect this with 24% of the shotshells shipped in 2019 shipped in March at the beginning of the spring season with another peak, 12%, in October ahead of the fall turkey season. The demand for turkey shells peaks twice a year, but with the fall turkey season peak half that of the spring.

Bill Sumner, President of Chattanooga Shooting Supplies , confirmed planning is critical to the success of a business. Chattanooga has an inventory manager who keeps track of where product is, what orders are coming in and ensures all flow within particular dates to match appropriate seasons. Even so, it takes an entire team planning year-round to make everything work.

“When we’re starting to ramp up for fall,” Bill said, “a lot of that buying will happen through the summertime and we’ll be planning late spring early summer for fall buying. Not to say that we’ll buy everything then and not all manufacturers are necessarily shipping by then, but the plans will certainly be in place by then.” Planning can begin way earlier, but a typical threshold is for dealers to have inventory 60 days ahead of season. This gives dealers an opportunity to secure advertisements and finalize marketing campaigns knowing they will have the inventory to support it. To support this, distributors need to begin planning for a season at least 90 days prior. Some manufacturers require orders three to four months in advance.

Steve Trommer, owner of Everything Outdoor Camping and Tactical in Medina, Ohio starts his planning early. “Seasonality and appropriate timing are always of concern. You must ensure that you identify key products 3 to 4 months prior to spring, summer, fall, and winter. This strategy has changed a little due to the limited availability of some products.” This means two things – that identifying a relevant product doesn’t mean you can get it and that consumers are compensating for limited product availability by altering their buying habits. Trommer noted that he found hunters have started purchasing next season’s ammo at the end of this hunting season. Some products are evergreen. “We have started identifying those items that we must keep in stock year-round to make sure we continue to have foot traffic in the store,” Trommer said.

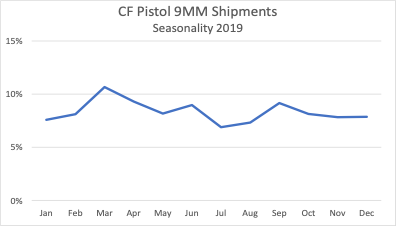

Sumner echoed this sentiment, calling out concealed carry as an area they are constantly carrying inventory for. “Our primary market isn’t as much in the fall or spring seasons any more as much as it is in kind of a year-round season, which is concealed carry,” he said. SCOPE data supports this. Sales of 9mm ammunition remain relatively constant at approximately $4,000,000 per month. There are no significant dips or peaks in the graph indicating demand is steady.

To determine when to stock what, Sumner turns to historical data. “Historical for the last couple years is more difficult to interpret today…just because of the anomalies of what we’ve seen through COVID,” he said. Trends are relevant, but the quantities are different. “We have a new level of normal today that we’re buying to than we were in 2019,” he explained

To determine when to stock what, Sumner turns to historical data. “Historical for the last couple years is more difficult to interpret today…just because of the anomalies of what we’ve seen through COVID,” he said. Trends are relevant, but the quantities are different. “We have a new level of normal today that we’re buying to than we were in 2019,” he explained

Historical data can’t always account for new products. Sumner explained everyone must take their “best guess of what’s gonna be hot.” Some of this varies by region. “The types of firearms that we’re selling to customers who are western hunters are much different than those types of products that we’re selling to those that are on the east coast,” he said. He also attributed some of CSI’s success due to the fact they carry accessories and gear besides guns and ammunition. Other times, a particular platform or model is especially popular. Last year, Mossberg’s 940 Pro Turkey optics-ready shotgun was very popular, largely due to it’s 18.5” barrel and optics-ready cut.

Whether you are a distributor or dealer, timing matters and it isn’t just up to one person. Seasons can be pretty standard from year to year, but the circumstances change. Some models are more popular than others or you may have to stock a particular product early in preparation for consumer rebates. Ignoring seasonality means deficient or excess inventory and missed opportunities. The key to successful planning is relying on facts and data, not perception. Take calculated risks using data as a foundation. SCOPE data takes the guesswork out of planning.