During “the Surge” in 2020 and 2021, firearm manufacturers saw an increase in demand for guns to accessories to optics.Ammo saw a massive spike in sales right away and then struggled to catch up on production, which led to high demand and low supply. Looking at the wholesaler shipment and sales data from the first half of 2022, sales of all optics appeared to shadow the decrease in the overall market and inventory mix as the surge curtailed. While all optic sales trended downward in the past year, SCOPE DLX data showed red dot sales declined at a sharper rate than other products within the mix of the optics market.

NASGW

Recent Posts

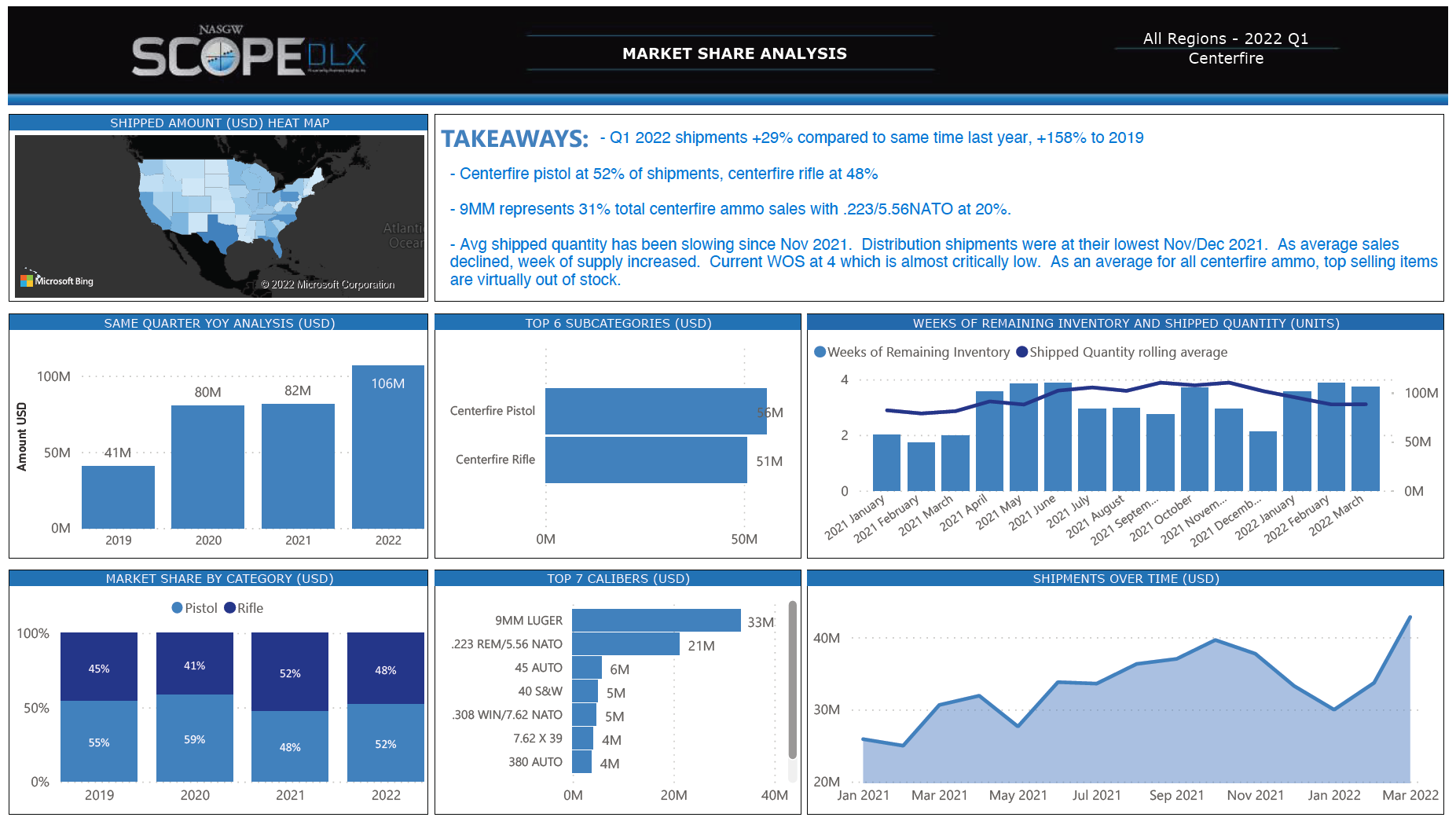

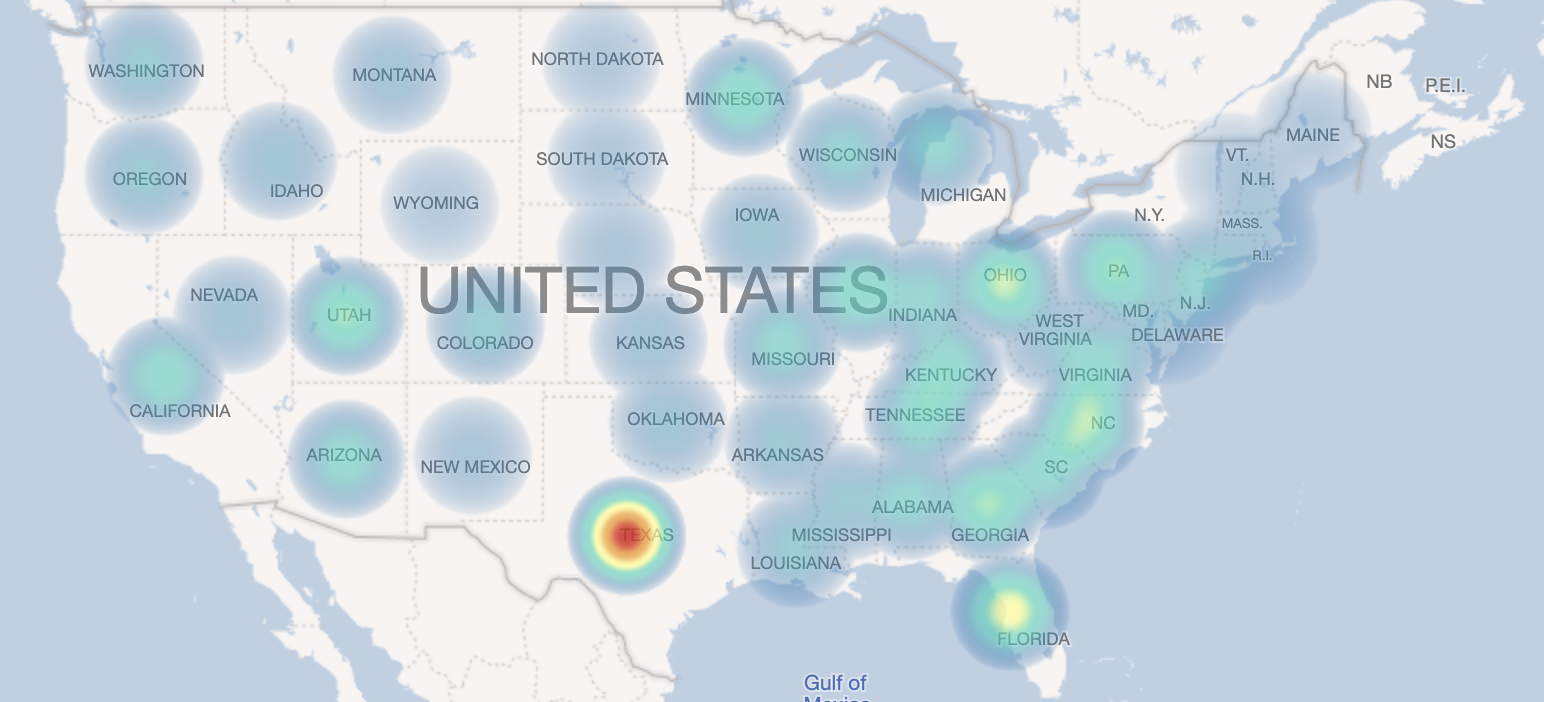

According to the SCOPE DLX Q1 Report, the pandemic surge of 2020 and 2021 is officially over. Shipments have slowed and inventory is building. Despite the drop off, most categories are still trending above pre-pandemic levels, an encouraging sign that the industry is still strong despite the slow down since the the peak of the surge. "Plan sales relative to 2019 performance with a 15-20% increase," mentions Tom Hopper, NASGW Senior Data Analyst, in his key takeaways found in the report.

Tags: Recent News, SCOPE™

NASGW Releases The Q1-2022 SCOPE Report from SCOPE DLX Data

Tags: SCOPE™

The NASGW Launches SCOPE PLX, the First Industry-Wide Product Information Management System for Shooting Sports

Ankeny, IA (March 9, 2022) - The National Association of Sporting Goods Wholesalers (NASGW), the association representing shooting sports wholesalers, manufacturers and their trade partners, takes one big step toward product standardization across the industry with its launch of SCOPE PLX (Product Link Exchange) this week.

Tags: Recent News, SCOPE™

Coreware Partners with NASGW to Expand Retail Sales Data in SCOPE CLX

Ankeny, IA (January 17, 2022) -

Coreware, a leading point of sale platform in the shooting sports industry has partnered with NASGW to expand SCOPE CLX, a retail sales data platform designed to analyze consumer buying trends.

Coreware’s support of SCOPE CLX will help NASGW advance its goal to grow the shooting sports industry by collecting, standardizing and analyzing data. The addition of Coreware will add anonymous sales from over 300 stores, making SCOPE CLX the largest sample of the independent FFL market.

Tags: Recent News, SCOPE™

Ankeny, IA (September 28, 2021) – As part of NASGW’s continued effort to expand integrations with shooting sports POS providers to supply aggregated data to the robust SCOPE™ suite of data tools, NASGW and Orchid LLC are excited to announce a integration with Orchid’s new point of sale system, Orchid POS™. Orchid clients will contribute to aggregate non-confidential firearm sales data to provide manufacturers, distributors and gun stores with a better understanding of product performance and sales trends.

Tags: Recent News, SCOPE™

Executives, including those in the shooting sports industry, have the opportunity to lead their business into a more data-driven culture. One Harvard Business Review study, which surveyed 646 executives, managers and professionals from all industries around the globe, found many corporations are integrating data capture and analysis into their decision-making processes. In fact, many business executives are enhancing their skills to allow them to integrate analytical tools into their business decision-making practices.

Tags: SCOPE™

Why Data is Good for Company and Industry-Wide Collaboration

Big data is all the rage right now, and while it may seem like just a buzzword, there are real, tangible benefits to incorporating data into your business’ processes. One of those benefits is the ability to more easily collaborate across your company and the shooting sports industry.

Tags: SCOPE™

Whether you have a full-service marketing team in-house, a single marketing employee or you hire an agency to do it for you, your marketing team already knows how important data is. They’re likely digging into Google Analytics, Facebook Analytics and other sophisticated platforms on a daily basis to better understand and reach your current and prospective buyers. What they may not have, though, is the data platform created just for the shooting sports industry.

Tags: SCOPE™

As many things begin to return to “normal” this summer, the big question is whether or not the shooting sports industry will return to normal as well. This quarter, we may have our answer. After a year of trying to keep up with the demand for firearms and accessories, the last month has shown a year-over-year decrease in firearm sales – the second month of decreasing sales since the beginning of 2021 – according to Small Arms Analytics. That said, the overall sales of 2021 so far are still outpacing 2020.

Tags: SCOPE™