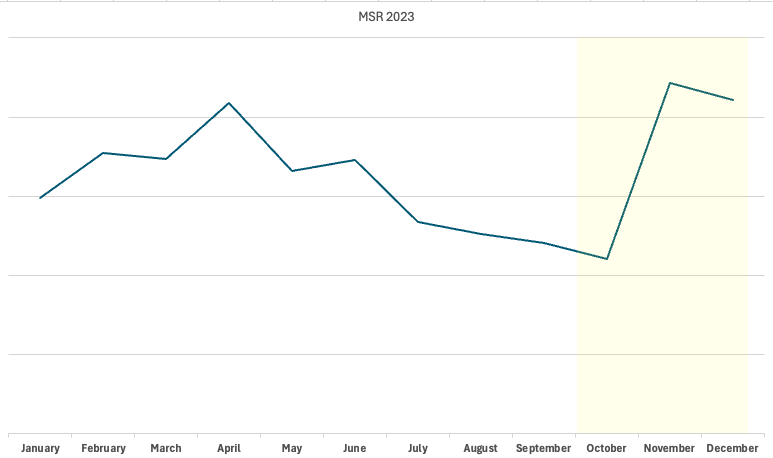

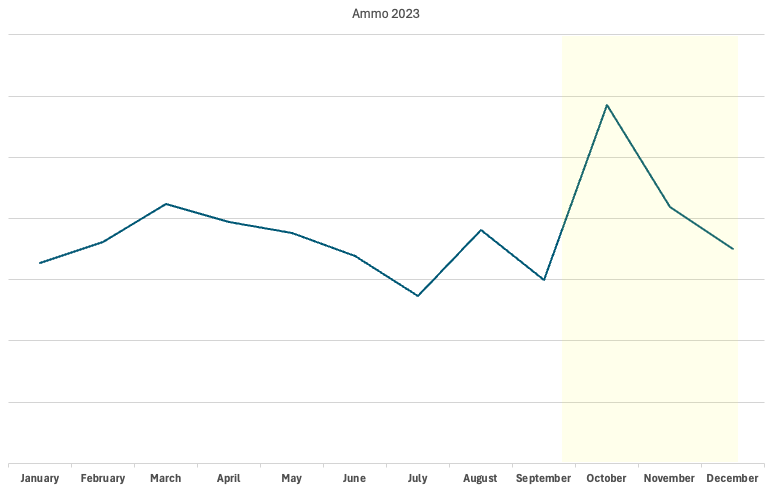

2023 firearm sales were on track to come in depressingly below 2022 sales. The number of June, July, August, and September NICS checks were 19.6%, 17.0%, 13.1%, and 8.2% lower respectively than 2022 checks for the same months. August 2023 checks were actually only 0.4% above 2019 levels, indicating that perhaps the pandemic-associated rise across the industry had truly come to an end. Ammunition that used to be impossible to find lined the shelves and MSRs were particularly slow to sell, some gun stores not even taking them as trade ins.

This all changed in October 2023 when a sudden and unexpected 8.3% jump in NICS checks moved the needle. 2023 Firearms sales — as estimated by NICS checks — were expected to come in 10% lower than 2022 numbers. They actually came out only 4% below — an astounding recovery.

This spike directly coincided with the Israeli-HAMAS War, which started on October 7, 2023 when a HAMAS terrorist attack killed approximately 1,200 Israelis. World conflict makes people nervous, especially when civilians are involved, and inspires renewed interest in home and self-defense. Recent data released by the Anti-Defamation League, a Jewish advocacy group, counted 3,283 antisemitic incidents in the U.S. between October 7, 2023 and January 7, 2024, a 361% increase from the year prior. Combined with protests and the uncertainty surrounding the 2024 Presidential election, it makes sense that gun sales increased.

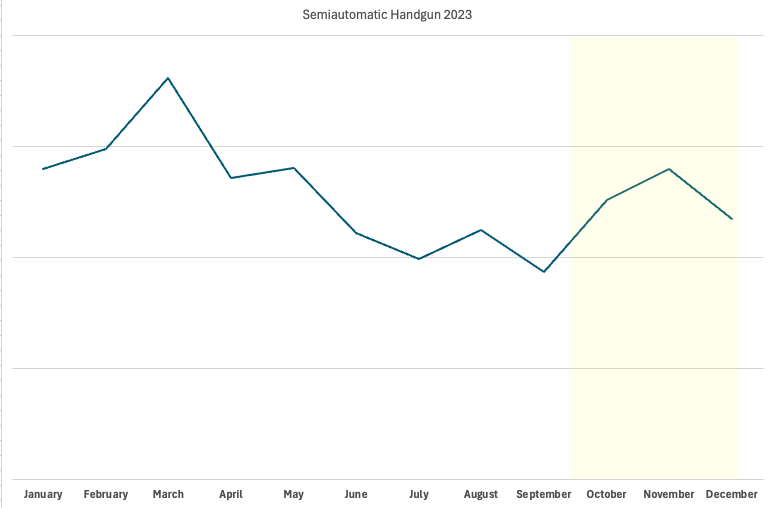

Most consumers aren’t concerned with hunting more or shooting recreationally. Much of the rise in sales is attributed to increased interest in MSRs (which previously had been stagnant) as well as in semi-automatic pistols. Semi-automatic pistol sales eroded from over 140 million dollars in May 2023 to under 90 million in September of 2023. October and November 2023 saw approximately 115 million and 140 million dollars in sales. Sales dipped again in December 2023, indicating the fourth quarter rise in sales wasn’t due to a continuing trend but due to a more singular happening. This supports the conclusion that Middle East unrest had a stunning effect on the U.S. market. Not all credit can be given to the Israel-HAMAS conflict though— fighting continues in Ukraine and domestic tensions tend to rise during an election year – all the more reason for Americans to think about their own safety. The holiday season also provided another reason to buy. Combined with world events, it’s not too far fetched to guess that loved ones bought firearms for one another.

SCOPE data divides semi-automatic pistols into four size groups based on barrel length: pocket pistol (<3”), sub-compact (3-3.5”), compact (>3.5”, <4.5”), and full size (>4.5”). Year over year, distribution percentages from 2022 to 2023 remained approximately the same by size, varying by no more than 2.3%. 2023’s fourth quarter, however, told a different story. Both pocket and full-size handguns increased beyond 2022 levels. October and November showed exceptional growth among all sizes, December finishing with flat shipments. Compact pistols saw the least change in the fourth quarter. This is surprising as sub-compact and compact models are generally most associated with concealed carry. The growth of pistols on both ends of the spectrum, pocket and full size, could have any number of explanations. Major manufacturers offered consumer rebates on popular pocket pistols, making them especially attractive. Full size guns are also often preferable for home defense as carrying on the person isn’t as much of a concern as shoot ability and capacity.

CLX data largely confirmed what distributor orders showed. Pocket pistols and full-size guns saw surprising growth towards year’s end. The data differed when it came to compact guns: December 2023 sales outpaced December 2022. Year over year by size, pocket pistols came in at 2.1% of 2023 sales, just under the 2.4% of 2022 sales. 2023 compact pistol and full-size pistol sales exceeded 2022 retail sales of each size by a full percentage. Having CLX data allows you to see the full picture. While distributor sales didn’t indicate a rise in compact pistol sales, retail sales showed that consumers were buying them. The lack of increased orders suggests retailers already had significant compact handgun inventory on the shelves. Excess ammunition inventory (9mm and 5.56) also vanished — consumers either buying for practice, safekeeping, or both.

It’s important to note that 2023’s stellar finish didn’t push the year’s sales ahead of the previous year, but brought it awfully close. December was the first and only month in 2023 in which semi-automatic handgun sales exceeded those in 2022 for the same time period. This is just another example of an age old adage – never count your chickens before they’re hatched. Anything can happen at any time that has a positive or negative effect on the market – whether miles away or across the globe.